AePS (Aadhar Pay)

Join us Today

AePS (Aadhar Pay)

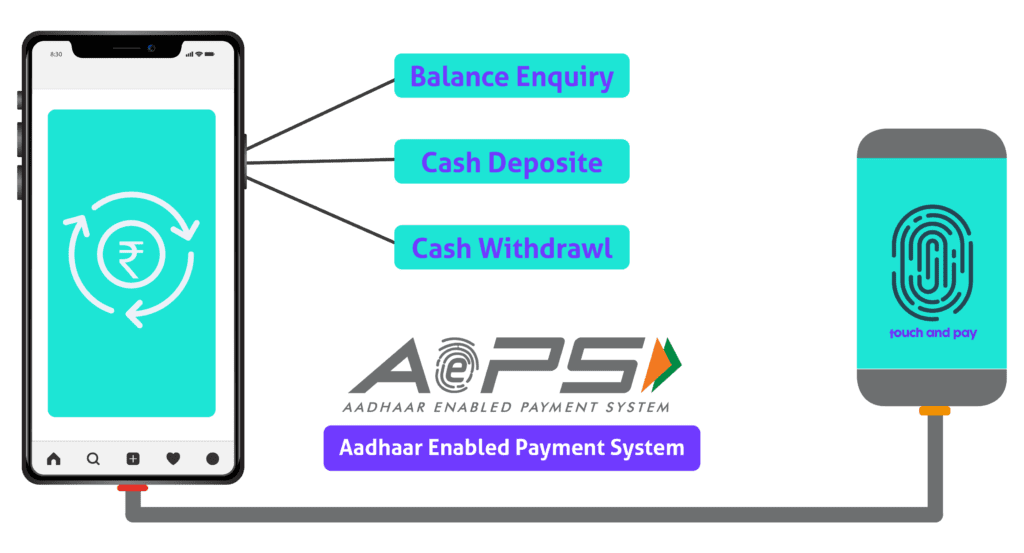

Aadhaar Enabled Payment Systems (AePS) allows your customers to make hassle-free payments and secure withdrawals while also availing other banking facilities like balance enquiry, mini statement and others from their Aadhaar-linked accounts. As an AePS service provider, retailers and shop owners can gain additional commission while enabling their customers to gain access to services from the easily accessible location.

You Can do these with AePS (Aadhar Pay)

Join us Now

Join Erupaiya as a Channel Partner, API User or start with our White-Label Solutions.

+

API Users

+

Master

Distributors

+

Distributors

+

Retailers

Frequently Asked Questions

What is AePS ?

What can we do with AePS ?

AEPS is nothing but an Aadhaar-enabled payment system through which you can transfer funds, make payments, deposit cash, make withdrawals, make enquiry about bank balance, etc.

Is there any Transaction Charges for AePS ?

No, There are no any Charges for AePS. You can Earn Profit margin on Every transaction with AePS. Thus, for each transaction done by the customer, you would get a 1.25% commission on that. It means that there is a lot of scope for earning money through AePS if you become a member of GST Suvidha Kendra.

What are the Benefits of AePS ?

Benefits of AePS are as follow:

- Aadhaar enabled Payment System is easy to use, safe and secure payment platform to avail benefits by using Aadhaar number & biometrics.

- Aadhaar enabled Payment System is based on the demographic and biometric/iris information of an individual, it eliminates the threat of any fraud and non-genuine activity.

- Aadhaar enabled Payment System facilitate disbursements of Government entitlements like NREGA, Social Security pension, Handicapped Old Age Pension etc. of any Central or State Government bodies using Aadhaar authentication.

- Aadhaar enabled Payment System facilitates inter-operability across banks in a safe and secured manner

- Reaching the unreached – The model enable banks to extend financial services to the unreached clients beyond their branch network as beneficiaries of the BCs are mostly located at unbanked and underbanked areas.

Is it Safe and Secured ?

Is System Stored My Data ?

The AePS is a valuable facility for those who are able to use it safely. A series of recent scams have exposed the vulnerabilities of the Aadhaar-enabled Payment System (AePS). The AePS enables a person to withdraw money from her bank account anywhere in the country using a local “business correspondent” (BC)

Looking For An Excelent Business Solution ?

Call us on +91-7350-7350-46